Kevin D. Williamson offers a

sobering perspective on our national debt.

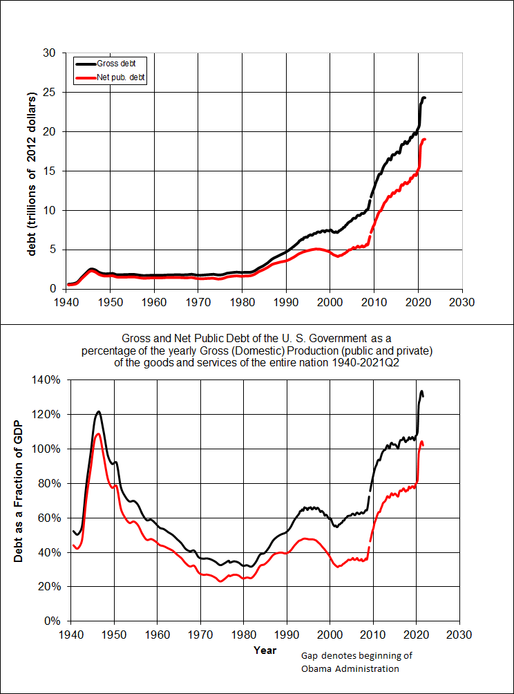

Just a reminder: We are in trouble.

I have argued that the real national debt is about $130 trillion. Let’s say I’m being pessimistic. Forbes, in a 2008 article, came up with a lower number: $70 trillion. Let’s say the sunny optimists at Forbes got it right and I got it wrong.

For perspective: At the time that 2008 article was written, the entire supply of money in the world (“broad money,” i.e., global M3, meaning cash, consumer-account deposits, checkable accounts, CDs, long-term deposits, travelers’ checks, money-market funds, the whole enchilada) was estimated to be just under $60 trillion. Which is to say: The optimistic view is that our outstanding obligations amount to more than all of the money in the world.

Global GDP in 2008? Also about $60 trillion. Meaning that the optimistic view is that our federal obligations outpace the entire annual economic output of human civilization.

I've got some change in a basket somewhere if it will help.

No comments:

Post a Comment